A Complete Guide to Home Insurance Policy

Our residence is the location, which supplies us with the heat as well as peace of mind after the tough labor of a day. Residence is one of the most important ownership which we have, so you would definitely concur to do whatever for shielding this important possession of yours.

Think about taking an action further and also protect your residence from the unpredicted occasions, with the assistance of the property owner’s insurance plan.

What is Home Insurance?

Residence Insurance, which is additionally known as home owner’s insurance coverage is a sort of building insurance coverage which covers a personal residence. This is an insurance coverage, which combines numerous individual insurance coverage protections including, loss of some individual belongings, or some responsibility insurance. This insurance additionally provides a protection for the accidents, which might happen in your home.

Benefits of Home Insurance: –

No one can refute the truth that, the homeowner’s insurance policy is a should point for everyone to choose. There are some important benefits of this policy that will include some persuade in your life. Such as …

- You can get extensive protection for both the content as well as the framework of your residence.

- This plan can offer you with a proper security to your possessions from any type of kind of mishaps.

- Purchasing a home owner’s plan can cost you with a fairly lower costs rates, contrasted to the various other plans.

- The unexpected occasions, which might happen at your residence can quickly be met this policy. Thus, your peace of mind will certainly not be interrupted by anything else.

- Timely insurance coverage payouts allow family members to undergo restoring procedure swiftly. This helps the household to carry on in their houses for leading a regular life once again.

The Coverage Area of Home Insurance: –

The insurance coverage area of the policy is likewise a vital point for you to think about, at the time of buying the plan. The protection location consists of:.

Damage to the Interior or the Exterior of the Property:

An event of damage, because of fire, storms, lightening or some other sort of catastrophe, your insurance firm will most definitely compensate you for repairing your house or they might additionally assist you in reconstructing your residence totally. Problems that are the results of floodings, earthquakes and also inadequate home maintenance is normally not covered as well as you may require separate cyclists if desire that sort of security.

Burglary or Theft Coverage:

With the help of this policy, the contents of your home are likewise offered with a protection, versus any kind of kind of loss because of robbery or any type of attempt of burglary. It likewise covers loss of precious jewelry, silver articles and also jewels maintained under lock and also trick. However, one point which you always keep in mind that, jewelry, silver articles or some jewels are only covered for burglary cover as well as not for burglary.

Loss or Damage to your Personal Belongings:

Apparel, furnishings, some other home appliances of your home will just get the coverage if they are destroyed in a disaster. However, most definitely there is a restriction on the amount which your insurance company will certainly repay to you. According to the Insurance Coverage Information Institute, the majority of insurance provider will offer insurance coverage for 50-70% of the amount of insurance policy you have on the structure of your residence.

Things to Consider before Buying a Home Insurance Policy:

Your residence, among one of the most important and also the biggest financial investment of your life can just be safeguarded effectively by opting for a house insurance coverage. Yet, there are some crucial things for you to think about prior to acquiring this policy.

- One of one of the most vital thing for you to recognize before buying this policy is that, just how much insurance will certainly be suitable for you. Take a step further, just after recognizing the actual value of your residence. Go with taking the aid from an experienced person in establishing your home’s worth.

- Go with guaranteeing your residence as well as the belongings for either obtaining the replacement price or the actual cash worth. It is extremely crucial for you to guarantee your residence for at least 80 percent of its replacement worth. On the other hand, the real cash money value is the quantity, which would certainly be required for fixing or changing the damages of your home, after a problem.

- Don’t neglect to double check the policy terms, when you are finished with the procedure. Click via the insurance coverage company’s internet site for confirming the quotes. Additionally, look for out some effective methods for lowering the cost.

- One more important facet, which should be thought about at the time of getting a house owner’s insuranceis that, go with selecting a business which has a great reputation.It is constantly essential to pick a business that is well equipped to aid you at any point of time.

Conclusion: –

House owner’s plan is a multiple-line plan, that includes both the home insurance and the liability insurance coverage. The cost of this insurance coverage generally depends upon your home as well as which added endorsements or motorcyclists are attached to the plan. If, the visibility of numerous insurance supplier has astonished you, after that certainly go with clearing your doubts with the assistance of some seasoned specialist of the same field.

Retirement Red Flags: The 5 Worst Habits to Leave Behind

Retirement Red Flags: The 5 Worst Habits to Leave Behind  Navigating Medicare’s IRMAA: Four Essential Insights

Navigating Medicare’s IRMAA: Four Essential Insights  Shifting Tides: The Exodus of Insurance Companies from California

Shifting Tides: The Exodus of Insurance Companies from California  Medicare and ACA Call Center Workers Strike: Unpacking the Essentials

Medicare and ACA Call Center Workers Strike: Unpacking the Essentials  Walmart’s Healthcare Horizon: Expanding Insurance Reach in Florida

Walmart’s Healthcare Horizon: Expanding Insurance Reach in Florida  Revolutionizing Food Delivery: HSA and FSA Cards Welcomed by DoorDash and Instacart

Revolutionizing Food Delivery: HSA and FSA Cards Welcomed by DoorDash and Instacart

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers  Anticipating Savings: How a Landmark Court Case Could Make Home Sellers’ Costs More Affordable

Anticipating Savings: How a Landmark Court Case Could Make Home Sellers’ Costs More Affordable  5 Imperative Facts to Acknowledge Before You Opt for Debt Settlement

5 Imperative Facts to Acknowledge Before You Opt for Debt Settlement  Save Money During the Winter Months with These Easy Tips

Save Money During the Winter Months with These Easy Tips  Credit Rating: How To Improve Credit Rating?

Credit Rating: How To Improve Credit Rating?  Top Property Investment Tips

Top Property Investment Tips  Generosity and Love: How — and Why — to Give to Your Grandkids

Generosity and Love: How — and Why — to Give to Your Grandkids  The Changing Landscape: Husbands and Wives Earning Equally

The Changing Landscape: Husbands and Wives Earning Equally  Medicare and ACA Call Center Workers Strike: Unpacking the Essentials

Medicare and ACA Call Center Workers Strike: Unpacking the Essentials  Empowering Borrowers: New Rules Bring Enhanced Protections for Student Loan Holders

Empowering Borrowers: New Rules Bring Enhanced Protections for Student Loan Holders  How to Save for a Mortgage Deposit?

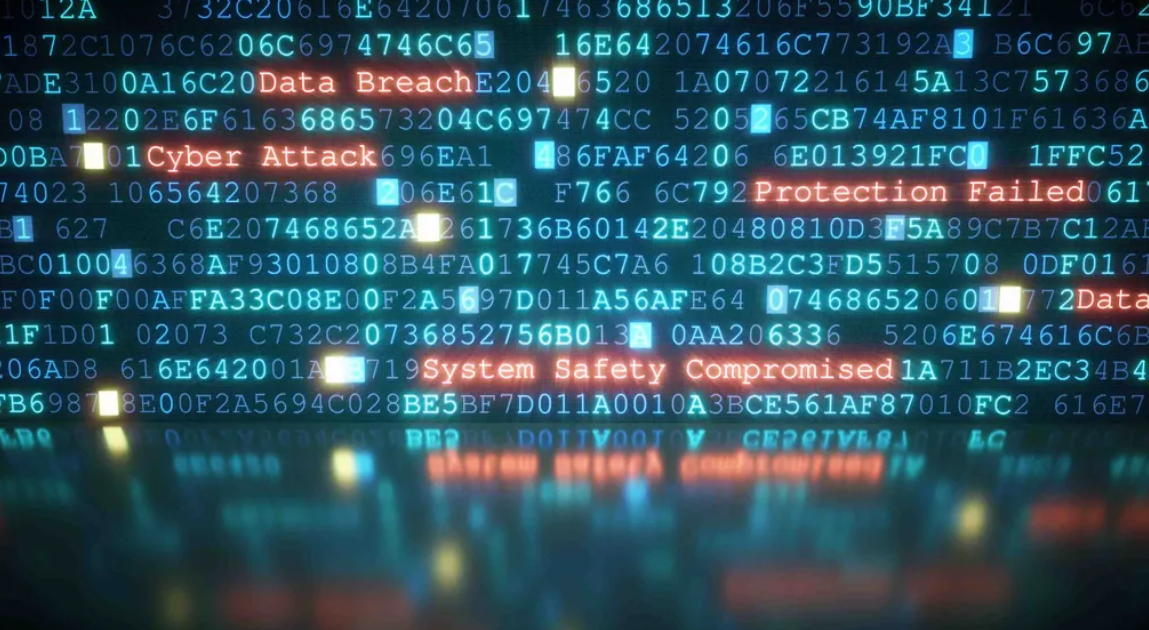

How to Save for a Mortgage Deposit?  Empowering Equifax Breach Victims: The Benefits of Free Credit Monitoring

Empowering Equifax Breach Victims: The Benefits of Free Credit Monitoring  Saving for Your Grandchildren’s Future

Saving for Your Grandchildren’s Future  A Ray of Relief: $9 Billion More in Student Loan Debt Forgiven

A Ray of Relief: $9 Billion More in Student Loan Debt Forgiven